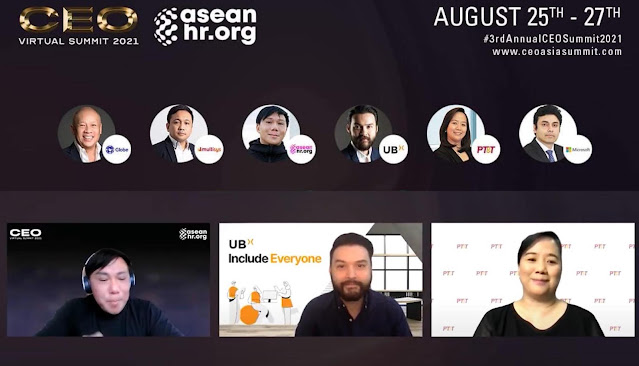

UBX SME Head for Transformation Bjorn Pardo was one of the speakers at this year’s CEO Virtual Summit, wherein he talked about how the government has helped paved the way for the mass adoption of digital financial services among Filipinos, as well as the importance of being omnipresent and being embedded in today's ever-shifting digital landscape, regardless of the industry or size of an organization.

"The government has definitely played a huge role in the digital adoption that has happened in the past years, even before the pandemic, and it really takes something like that for things to actually start to move."

An example of a government-led initiative to promote the mass adoption of digital services is the National Retail Payment System, which Pardo said has helped make digital payments and inter-bank transactions easier and more convenient.

"Even in some first world countries and other mature countries in terms of digital adoption, you won't see this level of ease to transfer funds from different banks, and that has definitely improved commerce and the way people and businesses move money."

In late 2020, in a bid to help improve the delivery of digital services to Filipinos, the Banko Sentral (BSP) released guidelines on the establishment and operation of digital banks in the country, classifying them as a new category apart from traditional financial entities like commercial banks, thrifts, and co-operatives.

"The government is definitely much more open and much more helpful to businesses these days, and the BSP is doing a lot more recently from opening up digital banks, to digital banks coming to the Philippines, and this new rise of open finance. I think there's a lot the government is doing and we're going to see a lot of enormous growth even in just the next few months."

Speaking about the recent boom in the use of digital services in the country, Pardo said that while this has provided new opportunities for businesses to connect with customers, it has also resulted in a more competitive market where businesses must be where their customers are to gain an edge.

"In this day and age, it's important that you're omnipresent, that you're everywhere. Gone are the days when you can set up something and customers will come to you. You have to be where they are."

Since its started operations in 2019, UBX has helped countless businesses establish and strengthen their digital presence. From lending platform SeekCap and end-to-end payments platform bux, to e-commerce site builder and the country's very first decentralized payment network i2i, UBX has been empowering enterprising Filipinos with the means to get their business ideas off the ground and thrive in the digital world.

Beyond SMEs, UBX is also enabling financial inclusion by providing solutions that make financial services more accessible especially to the underserved. UBX has been doing this not just through first-in-industry solutions like its embeddable insurance platform Assure and digital identity platform Akin, but by partnering with organizations that share the vision of enabling financial inclusion through technology and innovation.

"When we first started, we were largely focused on the SMEs, as we felt they were the largest underserved market," Pardo said. "As we've grown, we started to realize that there are ways that we can reach all these underserved individuals by partnering with larger companies."

"At the end of the day, we're trying to embed different financial services into the venture that we're building, essentially making banking invisible."